Understanding motor insurance can be tough, especially the different parties involved. In this article, we’ll explore first-party, second-party, and third-party insurance. This will help you protect your vehicle and your money.

Motor insurance is a complex system of agreements. Knowing each party’s role is key. This article will help you understand your motor insurance policy. It will show how it protects you.

Key Takeaways

- Comprehend the distinct roles and responsibilities of first-party, second-party, and third-party insurance coverage.

- Understand the legal requirements and benefits associated with each type of motor insurance protection.

- Learn how to navigate the claims process and maximize the coverage provided by your motor insurance policy.

- Discover the cost considerations and potential limitations of different motor insurance coverage types.

- Gain insights into the importance of selecting the appropriate motor insurance coverage for your unique needs.

Understanding the Basics of Motor Insurance Coverage Types

Knowing about motor insurance types is key for car owners. The right policy offers great protection against unexpected road incidents. Let’s look at the main parts of motor insurance and the laws for car owners.

The Importance of Knowing Your Insurance Parties

Motor insurance can be tricky, with many parties involved. Knowing who they are helps you make smart choices. This ensures you get the right coverage.

Key Components of Motor Insurance Policies

Insurance policies have important parts like liability, collision, and comprehensive coverage. Knowing these helps you protect your car better. It also helps you choose the best policy.

Legal Requirements for Motor Insurance

In many places, you must have motor insurance to drive. Not having it can lead to fines and losing your driving license. It’s important to know the local laws to avoid trouble.

| Insurance Coverage Type | Description | Legal Requirement |

|---|---|---|

| Liability Coverage | Protects against claims from other parties for bodily injury or property damage caused by the policyholder. | Often mandatory |

| Collision Coverage | Covers the cost of repairing or replacing the policyholder’s vehicle in the event of a collision. | Optional, but recommended |

| Comprehensive Coverage | Provides protection against non-collision-related damages, such as theft, vandalism, or natural disasters. | Optional, but recommended |

Understanding motor insurance basics helps you protect your vehicle. Knowing your insurance parties and the laws is crucial. This way, you can make smart choices for your car’s safety.

What is mean by first-party, second-party, and third party in third party motor

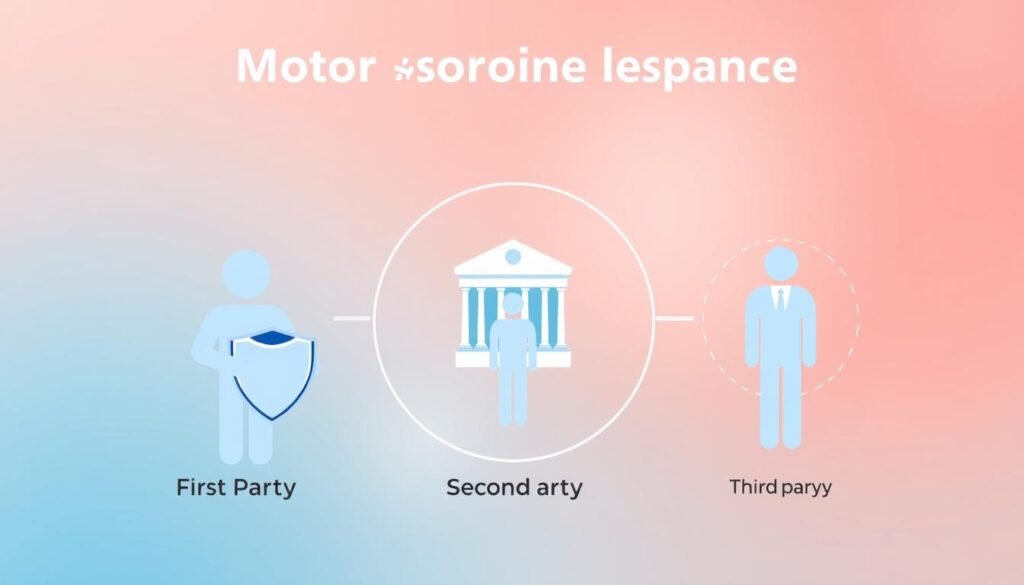

In the world of motor insurance, knowing who’s involved is key. The different parties, insurance definitions, and types of coverage all matter. They help figure out who’s right and who’s responsible when it comes to insurance.

First-Party: The first-party is the person who bought the insurance. This is the one who pays the premiums and can make claims for covered damages or losses.

Second-Party: The second-party is the insurance company. They collect premiums, handle claims, and make sure the policy is followed. They must act fairly and provide the coverage they promised.

Third-Party: The third-party is anyone not the policyholder or the insurance company. This could be another driver, a pedestrian, or a property owner involved in an accident. They might get compensation from the first-party’s policy, depending on the incident and coverage.

“Understanding the roles and responsibilities of the various insurance parties is essential for navigating the complexities of motor insurance coverage and claims.”

Knowing about first-party, second-party, and third-party in motor insurance helps protect your rights. It makes understanding your coverage and handling claims easier, especially after an incident.

First-Party Insurance Coverage: Rights and Benefits

First-party insurance is key in motor insurance. It gives you rights and benefits. You can file a claim with your insurance for damages or losses, no matter who was at fault.

Claims Process for First-Party Insurance

Filing a claim for first-party insurance is easy. You’ll need to tell your insurance about the incident and give them any supporting documents. They’ll then decide on a settlement or reimbursement based on your policy.

Coverage Limitations and Exceptions

First-party insurance has its limits and exceptions. For example, it might not cover damage from natural disasters or intentional acts. Knowing your policy well can help avoid surprises when you file a claim.

Cost Considerations for First-Party Coverage

The cost of first-party insurance depends on several factors. These include your driving record, the type of vehicle, and coverage limits. While higher limits might cost more, they offer valuable protection. Think about the costs and benefits to choose the right coverage for you.

| Coverage Type | Typical Inclusions | Cost Considerations |

|---|---|---|

| Collision | Covers damage to your vehicle in a collision with another vehicle or object | Higher deductibles can lower premiums, but increase out-of-pocket costs |

| Comprehensive | Covers non-collision-related damage, such as theft, vandalism, or natural disasters | Premiums may be higher for more expensive vehicles or those with advanced safety features |

| Medical Payments | Covers medical expenses for you and your passengers, regardless of fault | Coverage limits can impact the overall cost, with higher limits typically costing more |

Second-Party Insurance: The Role of Insurance Providers

In the world of motor insurance, second-party insurance is key. Insurance providers play a big role in this system. They issue policies, handle claims, and protect policyholders.

Insurance providers offer and manage motor insurance policies. They act as a link between the policyholder and the insured. They assess risks, set premiums, and provide coverage to their customers.

| Key Responsibilities of Insurance Providers | Benefits to Policyholders |

|---|---|

| Underwriting and risk assessment Issuing and managing insurance policies Processing claims and providing payouts Ensuring regulatory compliance Maintaining financial stability and solvency | Access to comprehensive coverage Protection against financial losses Assistance in the claims process Compliance with legal requirements Peace of mind and financial security |

Knowing the role of insurance providers helps policyholders understand motor insurance better. This knowledge lets them make smart choices and stand up for their rights with their policy issuers.

Third-Party Insurance: Comprehensive Protection

Third-party insurance is key in motor insurance, offering broad protection. It doesn’t cover the policyholder’s vehicle like first-party insurance does. Instead, it protects others in an accident. It’s a must in many places and benefits drivers and pedestrians greatly.

Types of Third-Party Coverage Available

Third-party motor insurance policies offer several types of coverage:

- Liability Coverage: This pays for damages or injuries to others in an accident where the policyholder is to blame.

- Property Damage Coverage: It covers the cost to fix or replace the other party’s damaged vehicle or property.

- Personal Injury Coverage: This part of the insurance pays for the medical bills and lost wages of the injured party.

When to File Third-Party Claims

File a third-party claim if you’re not at fault in an accident. This ensures the innocent party gets compensation for their damages or injuries. The process involves sending documents like police reports and medical records to your insurance provider.

Benefits of Third-Party Insurance

The main advantage of third-party insurance is the wide protection it offers. It provides liability coverage, protecting both the policyholder and the affected third party financially. It also helps lessen the financial stress on the accident victim, ensuring they get the compensation they need.

Conclusion

This article has given a detailed look at who’s involved in motor insurance. We’ve covered first-party, second-party, and third-party roles. Understanding these helps readers make smart choices to protect their cars and themselves.

First-party coverage helps with the policyholder’s own vehicle and medical costs. Second-party insurance deals with the insurance company’s duties. Third-party insurance protects against claims from others in an accident.

With this information, drivers can pick the right coverage comparison for their needs. This ensures they follow local laws and feel secure on the road. It also helps protect their money if something unexpected happens.

FAQ

What is the difference between first-party, second-party, and third-party in motor insurance?

First-party insurance covers your own vehicle and any injuries you get. Second-party insurance is about the insurance provider who gives you the policy. Third-party insurance helps if you damage someone else’s property or hurt them.

What are the key components of a motor insurance policy?

A motor insurance policy has several key parts. These include liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage.

What are the legal requirements for motor insurance in my area?

Laws about motor insurance vary by place. Most places require a basic liability coverage to drive on public roads. Always check with your local authorities to make sure you have the right insurance.

How does the claims process work for first-party insurance coverage?

For first-party insurance, you file a claim with your provider. They check the damages and decide how much to pay. They might also help with repairs or replacing your vehicle.

What are the limitations and exceptions of first-party insurance coverage?

First-party insurance has its limits, like deductibles and coverage caps. It also might not cover all damages or incidents. Always read your policy to know what’s not covered.

How do insurance providers function as the second party in the motor insurance relationship?

Insurance providers are the second party. They issue policies, collect premiums, and manage the coverage. They handle claims, payouts, and make sure your needs are met.

What types of third-party coverage are available in motor insurance?

Third-party coverage includes liability for property damage and bodily injury. It also includes uninsured/underinsured motorist coverage and personal injury protection. These coverages help if you’re involved in an accident with someone else.

When should I file a third-party claim in motor insurance?

File a third-party claim if an accident was caused by someone else. You need compensation for damages or injuries. This claim is against the at-fault party’s insurance.

What are the benefits of having third-party motor insurance coverage?

Third-party insurance offers wide protection for damages or injuries to others. It also covers legal liability in lawsuits. This coverage gives peace of mind and financial security.

Thanks for the new things you have uncovered in your writing. One thing I would really like to touch upon is that FSBO relationships are built as time passes. By presenting yourself to owners the first weekend break their FSBO is definitely announced, prior to masses start calling on Wednesday, you build a good link. By sending them methods, educational supplies, free reports, and forms, you become a great ally. By using a personal fascination with them along with their circumstance, you make a solid connection that, oftentimes, pays off in the event the owners decide to go with a realtor they know and trust — preferably you.